If you’re thinking of making a move this year, there are two housing market factors that are probably on your mind: home prices and mortgage rates. You’re wondering what’s going to happen next and if it’s worth it to move now or better to wait it out.

“The only thing you can really do is make the best decision you can based on the latest information available. So, here’s what experts are saying about both prices and rates.”

1. What’s Next for Home Prices?

One reliable place you can turn to for information on home price forecasts is the Home Price Expectations Survey from Fannie Mae – a survey of over one hundred economists, real estate experts, and investment and market strategists.

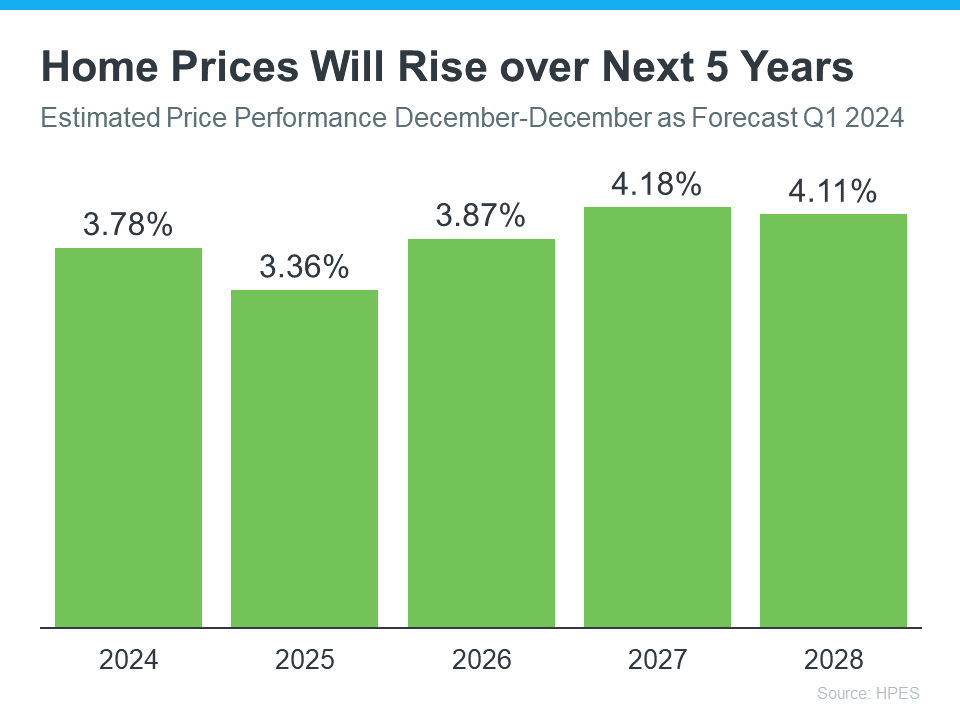

Home prices are expected to rise steadily over the next five years, with annual increases ranging from 3.36% to 4.18% as per the Q1 2024 forecast.

While the percent of appreciation varies year-to-year, this survey indicates that we’ll see prices rise (not fall) for at least the next 5 years, and at a much more normal pace.

What does that mean for your move? If you buy now, your home will likely grow in value and you should gain equity in the years ahead. But, based on these forecasts, if you wait and prices continue to climb, the price of a home will only be higher later on.

2. When Will Mortgage Rates Come Down?

This is the million-dollar question in the industry. And there’s no easy way to answer it. That’s because there are a number of factors contributing to the volatile mortgage rate environment, we’re in. Odeta Kushi, Deputy Chief Economist at First American, explains:

“Every month brings a new set of inflation and labor data that can influence the direction of mortgage rates. Ongoing inflation deceleration, a slowing economy, and even geopolitical uncertainty can contribute to lower mortgage rates. On the other hand, data that signals upside risk to inflation may result in higher rates.”

What happens next will depend on where each of those factors goes from here. Experts are optimistic rates should still come down later this year but acknowledge that changing economic indicators will continue to have an impact. As a CNET article says:

“Though mortgage rates could still go down later in the year, housing market predictions change regularly in response to economic data, geopolitical events and more.”

So, if you’re ready, willing, see how much home you can afford by clicking here and partner with a trusted real estate advisor to weigh your options and decide what’s right for you.

Bottom Line

Connect with a trusted mortgage advisor to make sure you have the latest information available on home prices and mortgage rate expectations. Together you’ll go over what the experts are saying so you can make an informed decision on your move.