If you’re a homeowner, there’s a good chance your net worth has seen a substantial increase over the past year thanks to rising home prices. Here’s a closer look at how homeowners are building equity faster than many might expect.

Understanding Home Equity

Equity is essentially the difference between the current market value of your home and the amount you owe on your mortgage. As home prices increase, so does your home equity.

Over the past year, the demand for homes has consistently outstripped supply, pushing home prices upward. This surge has directly translated into increased home equity for countless homeowners.

The Current Landscape of Home Equity Gains

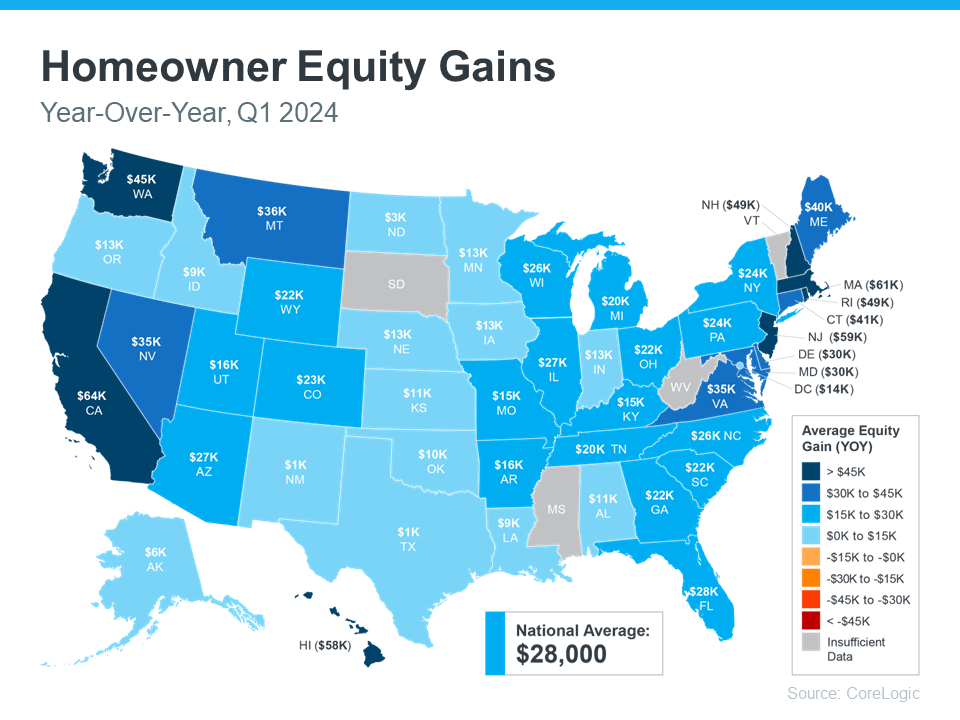

According to the latest Homeowner Equity Insights from CoreLogic, the average homeowner has seen their equity increase by $28,000 in just the last year. This is a national average, but regional variations exist. For a detailed look at how much equity has grown in each state, refer to the map included below, which uses data from CoreLogic to illustrate the equity gains across the country.

Equity Growth Since Before the Pandemic

For those who purchased their homes before the pandemic, the equity increase is even more pronounced. Data from Realtor.com indicates that home prices have surged by 37.5% from May 2019 to May 2024. Ralph McLaughlin, Senior Economist at Realtor.com, highlights the substantial equity boosts homeowners have witnessed:

“Homeowners have seen extraordinary gains in home equity over the past five years.”

Selma Hepp, Chief Economist at CoreLogic, further elaborates on the equity scenario:

“With home prices continuing to reach new highs, owners are also seeing their equity approach the historic peaks of 2023, close to a total of $305,000 per owner.”

Leveraging Your Home Equity

This significant buildup of equity offers several practical benefits. Homeowners can utilize their increased equity to start a business, fund education, or even facilitate the purchase of their next home. Upon selling, the equity you’ve accumulated can substantially cover—or possibly exceed—the down payment for your next property.

Bottom Line

For those considering a move, the equity you’ve gained over recent years can be a powerful asset in facilitating your transition. If you’re curious about your home’s current equity and how you can leverage it for your next purchase, reaching out to a local real estate agent is a great starting point.