Why Selling Your House This Winter Gives You an Edge

When most people think about selling their home, they automatically picture spring the yard is green, the flowers are out, and everyone seems to be in house-hunting mode. But here’s the truth: spring isn’t always the smartest time to sell.In fact, selling your house this winter may actually give you a major advantage especially if you’re trying to stand out and make a confident financial move. Let’s break down why winter might be the opportunity most homeowners overlook. Winter Is When Your House Finally Stands Out Every year almost without fail the number of homes for sale drops as winter approaches. Realtor.com’s data shows the same pattern year after year: inventory dips in the winter, then rises again as spring arrives. And based on the latest numbers rolling in for 2025, we’re seeing that same trend start again. Listings are beginning to decrease as we close out the year and if history repeats itself (which it usually does), inventory will drop even further through winter. Here’s why this matters for you: Even with more listings than last year, we still aren’t anywhere near a “normal” market. Compared to 2017–2019 levels, today’s housing supply is still too low.So when winter inventory dips again, your home has less competition and more visibility. Think of it like this: Less competition = More attention on your home. If you list now before everyone else rushes back into the market in spring you get ahead of the crowd. Winter Buyers Are More Motivated Buyers Another big advantage to selling your house this winter? The buyers who are shopping right now are serious. They’re not browsing because it’s fun.They’re looking because they need to move for a job relocation, a lease ending, a life change, or a growing family. U.S. News puts it this way: “Buyers who brave the cold usually have a good reason they need to move and can make quick decisions.” And with fewer homes available in winter, they have fewer options to choose from. If you price and prep your house well, there’s a good chance your home becomes the one that checks their boxes. Motivated buyers + low inventory = stronger offers and quicker decisions. Why Not Wait Until Spring? Why This Matters for Buyers Trying To Stretch Their Budget Most homeowners wait to list until spring because it “feels” like the right time.But that’s exactly why waiting could hurt you. Spring brings more buyers – yes.But it also brings a flood of new listings. Suddenly, you’re competing with every homeowner who waited all winter. Winter gives you the opposite experience: Less noise Less competition More motivated buyers A cleaner shot at standing out Bottom Line: Winter Gives Sellers a Quiet Advantage If you’re thinking about selling, winter may be your best opportunity to: Stand out in a less crowded market Attract serious, motivated buyers Avoid spring competition Sell with more confidence and clarity You don’t have to wait for the “busy” season to make a smart move.Sometimes the quiet seasons work in your favor. If you want to understand what listing your home this winter could look like or whether it fits your financial goals connect with a trusted real estate agent in your area. A good agent can help you make sense of the numbers and take your next step with confidence.

Self Inflicted Inflation: The Inflation No One Talks About

Inflation is everywhere right now.Gas. Groceries. Insurance. Rent. But there’s another kind of inflation most people don’t want to talk about. Self Inflicted Inflation. This is the inflation we create ourselves through choices — not policies, not the Fed, not the economy. And with Christmas coming up, this problem is about to explode. Christmas Debt Is the Quiet Budget Killer Here’s a hard truth: Millions of people are still paying off 2023 and 2024 Christmas credit card debtand they’re about to add 2025 Christmas on top of it. That’s not inflation.That’s compounding bad decisions. A $3,000 Christmas at 22% interest can easily turn into $4,000+ by the time it’s paid off. Multiply that over multiple years, and now you’re stuck in a cycle where affordability feels impossible — because you’re financing yesterday’s memories with tomorrow’s income. 🎯 Dollars & Sense Rule:If Christmas requires debt, the budget is lying. Renting, Driving Luxury, and Saying “I Can’t Afford a Home” Let’s talk about the elephant in the parking lot. Someone says:“I can’t afford a house.” But they’re renting…With a $900 car payment…On a depreciating asset…While paying someone else’s mortgage. That’s not a housing problem.That’s an affordability choice problem. A car doesn’t build wealth.A home does. Dollars & Sense doesn’t make sense of choosing lifestyle flex over long-term freedom. The Top 3 Ways to Control Your Own Inflation 1. Stop Financing Holidays Set a Christmas sinking fund.If the cash isn’t there, the gift list gets smaller. 2. Delay the Car, Accelerate the House Drive boring now.Live free later. 3. Kill Lifestyle Creep Raises should buy margin, not payments. Freedom comes from breathing room, not bigger bills. Final Thought Inflation hurts.But Self Inflicted Inflation is optional. Dollars & Sense is about making today’s choices make sense for tomorrow’s freedom. If homeownership is the goal — your money has to agree.

How To Find the Best Deal Possible on a Home Right Now

If you’ve been wondering how to find the best deal possible on a home in today’s housing market, here’s the truth most buyers never hear: The real savings aren’t on the brand-new listings…They’re on the homes that have been sitting on the market. That’s where the most flexible sellers are.That’s where the biggest price cuts happen.And that’s where savvy buyers are finding homes other people scroll right past. In a market where every dollar matters, this strategy could be the difference between feeling stretched thin or finally breathing again. Let’s break it down. The Hidden Opportunity: 1 in 5 Homes Has Reduced Its Price This Year Here’s a number worth paying attention to: 20.2% of homes for sale have already dropped their asking price (Realtor.com). Even better?This trend is consistent nationwide, not just in select cities. That means: No matter where you live, there’s a real chance to score a better deal on a home. The challenge is knowing where to look — and that’s where your agent becomes your secret weapon. The Strategy: Target Homes That Have Been Sitting the Longest Homes that sit on the market longer than expected often tell a story. Sometimes the seller listed too high.Sometimes the marketing wasn’t strong.Sometimes buyers just moved on to the next shiny listing. But here’s the part most buyers miss: The longer a home sits, the more motivated the seller becomes. And that’s where opportunities open up for you. Your real estate agent can pull up listings with: High days-on-market Price cuts Seller concessions Fewer competing buyers These are the homes where you have real negotiating power. Why This Matters Realtor.com explains: “Less competition means fewer bidding wars and more power to negotiate the extras that add up… repair concessions, warranties, and closing credits.” And Bankrate backs it up: “During the quieter fall and winter months… sellers may be more willing to lower prices or offer concessions.” Translation? You can save thousands just by targeting the right listings. The Data Is Clear: The Longer a Home Sits, the Bigger the Savings According to the National Association of Realtors (NAR): Homes that stay on the market longer tend to sell for less than their original asking price. Even small percentages make a big difference. Example: If you buy a home at 94% of the original asking price, that discount may not feel dramatic, but: On a median-priced home, that’s roughly $24,000 in savings. Imagine what $24,000 could do: Reduce debt Grow your savings Allow you to buy furniture Lower your monthly payment Give you breathing room This is why experienced buyers don’t chase the “fresh” listings…They look for the motivated ones. As Zillow puts it: “If you’re hoping to strike a deal, look for homes that have been on the market for a while… You may find a motivated seller who is more willing to negotiate.” Why This Matters for Buyers Trying To Stretch Their Budget If you’re trying to maximize every dollar — especially as a young family working toward stability — this strategy gives you: More control More negotiating power More room in your budget Less competition When everyone else is running to the newest listings, you’re moving strategically and intentionally. Bottom Line If you want to find the best deal possible in today’s housing market, don’t follow the crowd. Look where others aren’t looking. With 1 in 5 sellers cutting prices and more homeowners becoming flexible by the week, the listings that have been sitting a little longer may be your smartest path to saving money — and getting more home for your dollar. Your next step? Talk to a local agent about the homes in your area that have been on the market the longest. Those are the listings that could put you closer to the home — and financial breathing room — you’ve been working toward.

The Top 2 Things Homeowners Need To Know Before Selling

Price It Right from Day One Before you sell your home, there’s one truth you should hold onto: the homeowners who succeed in today’s market aren’t the ones waiting for “the perfect moment.” They’re the ones who start with clarity, realistic expectations, and a plan that fits the real world not the highlight reels on social media. This year, a lot of homeowners walked away disappointed. Not because the market was broken… but because their expectations were. Realtor.com reports that 57% more homes were taken off the market compared to last year. These were homes that listed… but didn’t sell. And in most cases, it came down to two things:price and timing. The good news?When you understand these early, you step into the selling process feeling calmer, more confident, and more in control instead of stressed or blindsided later. Here are the top two lessons you can learn from the sellers who struggled this year. Let’s talk about pricing, the part most sellers wrestle with. Today, 8 in 10 sellers expect to get their asking price or more.But the reality is different. Redfin shows that only 1 in 4 (25.3%) sellers actually end up selling for above list price. So where’s the gap? A few years ago, you could set almost any number and buyers would rush in. Homes were selling in hours, and bidding wars were the norm. Today, buyers have options more than they’ve had in years which means they can be selective. If your price feels even a little too high, buyers scroll right past it. That’s exactly what happened to many homeowners this year. Instead of making a small, strategic price adjustment, they pulled their listings entirely and missed out on real opportunities. Here’s the part most sellers never hear: According to HousingWire, the average price cut right now is just 4%. That’s it. Four percent is often the difference between “no activity” and “multiple showings.” If those sellers had priced strategically from the start or made a simple adjustment sooner they likely would’ve sold. And here’s the part that brings the pressure down. If you’ve built equity over the years, you can price competitively and still come out ahead financially. Before listing, work with a trusted real estate agent to analyze comparable homes in your area. Together, you can find a price that’s competitive, realistic, and aligned with your goals. Don’t Rush the Process — Selling Takes Time Another common mistake is expecting your home to sell in a weekend. Many sellers are still comparing today’s market to the lightning-fast pace of 2020 and 2021. But those days were the exception, not the rule. Right now, the average timeline is closer to 60 days from listed to sold.And that’s normal. Think of it like going from highway speed to neighborhood speed.You’re not going slow you’re going the right speed for where you are. Today’s buyers are more intentional. They’re slowing down, comparing homes, and making thoughtful decisions. This is actually healthier for the market, and for you. So if you’re planning to sell: Don’t panic if your home doesn’t go under contract the first weekend. Don’t assume something’s wrong if you don’t get an immediate offer. Don’t rush the process and sabotage your own results. If you want your home to stand out, talk with your agent about strategic upgrades staging, photography, minor fixes, or value-driven pricing. Small improvements can create big momentum. With the right preparation and the right expectations, your home can still sell quickly. Bottom Line If you’re thinking about selling, don’t let fear shape your decisions let clarity guide them. The listings that struggled this year weren’t doomed…they were simply misaligned. You can still win in this market if you price with intention, stay patient, and work with an agent who understands what buyers are responding to right now. Success isn’t about waiting for the market to change.It’s about starting the process with the right plan and the right expectations from day one.

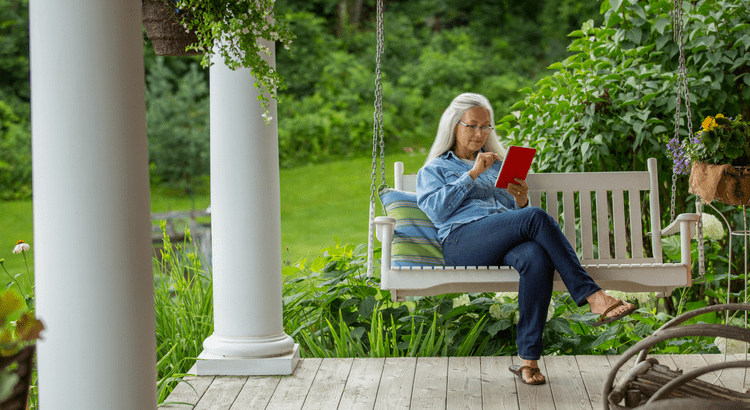

More Time to Buy a Home

If you’ve been waiting for the right moment, here it is: buyers finally have more time to buy a home. Unlike the frenzy of a few years ago—when houses sold within hours—today’s slower pace gives you breathing room. That means extra time to compare options, negotiate terms, and make confident decisions instead of rushing into a purchase. You Have More Time to Buy According to the latest data, homes are spending an average of 58 days on the market. That’s much more normal. And it’s a big improvement compared to the height of the pandemic, when homes were flying off the shelves in a matter of days (see graph below): That means you now have more time to make decisions than you have at any point in the past five years. And that’s a big deal. Now, you’ve got: Time to think. Time to negotiate. Time to make a smart move without all the pressure. More Time to Buy, Means Less Stress (and More Leverage) Based on the data in the graph above, you have an extra week to decide compared to last year. And nearly double the time you would have had at the market’s peak. Back then, fear of missing out drove buyers to act fast, sometimes too fast. Today, the pace is slower, which means you’re in control. As Bankrate puts it: “For years, buyers have been racing to snag homes because of the fierce competition. But the market’s cooled off a bit now, and that gives buyers some breathing room. Homes are staying listed longer, so buyers can slow down, weigh their options and make more confident decisions.” With more homes on the market and fewer buyers, you have more time to buy a home and not having to race to grab them, the balance has shifted. Bidding wars aren’t as common, and that means you may have room to negotiate. And you can actually take a breath before you make your decision. More listings + a slower pace = less stress and more opportunity But, and this is important, it still depends on where you’re buying. Nationally, homes are moving slower. But your local market sets your real pace. Some states are moving faster than others. It may even vary down to the specific zip code or neighborhood you’re looking at. And that’s why working with an agent to know what’s happening in your area is more important than ever. To see how your state compares to the national average (58 days), check out the map below: As Realtor.com explains: “While national headlines might suggest a buyer’s market is taking hold, the reality on the ground depends heavily on where and what you’re trying to buy. Local trends can diverge sharply from national averages, especially when you factor in price range, property type, and post-pandemic market dynamics.” A smart local agent can tell you exactly when to move fast and when you can take your time, so you never miss the right home for you. Bottom Line If the chaos of the past few years drove you to hit pause, this is your green light. The market’s pace has shifted. You have more time. More options. More power. And with the right agent guiding you, you’re in the best position you’ve been in for years. Connect with a local agent to talk about what the pace looks like in your area, and if now could be the right time for you to re-enter the market.

Buy Now or Wait? The Real Tradeoff With Mortgage Rates.

“Should I buy now or wait for mortgage rates to drop?” One of the biggest questions buyers are asking me right now Let’s look at the facts and the tradeoffs of buying now or waiting. What you need to consider. Well, let’s break it down… Where are Mortgage Rates Today, if You were to Buy Now After the latest jobs report came in weaker than expected, the bond market reacted quickly — and rates dropped to 6.55%, the lowest so far this year. That dip has many people wondering: “Is now a good time to buy a house 2025, or should I wait for mortgage rates to fall further?” According to the latest mortgage rate forecast 2025 housing market outlook, most experts agree we won’t see a dramatic drop. Projections suggest rates will hover in the mid-to-low 6% range through 2026. So while there may be small ups and downs, a major plunge isn’t likely anytime soon. Now, that may not seem like a massive drop, but trust me, buyers have been waiting for any sign of movement. Even small changes like this light a fire under the market because they hint that rates might be heading lower. But here’s the reality: Most experts aren’t expecting rates latest forecast to drop dramatically anytime soon. Projections show rates hanging in the mid-to-low 6% range through 2026. That means, yes, we’ll see ups and downs, but no massive plunge overnight. The Magic Number: 6% For many buyers, the tipping point is 6%. And it’s not just psychological — it’s real math. NAR data shows that if rates hit 6%: 5.5 million more households could afford a median-priced home Around 550,000 buyers would jump into the market within 12–18 months That’s a lot of pent-up demand waiting for the same moment. Should you wait to buy a home until interest rates fall to 6%? (See Infographic)Here’s the catch: if you’re waiting, millions of others are too. The Tradeoff of Buying Now Instead Waiting When rates eventually inch closer to 6%, here’s what will happen: Competition will heat up Inventory will shrink Home prices will rise Right now, buyers actually have an edge:✅ More homes available to choose from✅ Slower home price growth✅ Better negotiating power with sellers These opportunities may disappear once demand surges. Bottom Line So… buy a house now or wait for mortgage rates to drop?Rates aren’t expected to hit 6% this year, but when they do, you’ll likely face bidding wars and higher prices. If you’d rather shop with less competition, more options, and stronger negotiating leverage, the window of opportunity is open right now. The real question is: Do you want to buy when the market is calm, or when the race is on?